Renault Finance

Present in 36 countries across Europe, North Africa, South America, and Asia, Renault finances over a million vehicles per year. At Renault Finance, we specialise in developing practical & innovative ways to get you closer to your dream Renault. In order to enable the customers to acquire the vehicle of their choice, regardless of the budget, we offer a vast range of financial products guaranteeing flexibility, security, and peace of mind in terms of vehicle use and purchase.

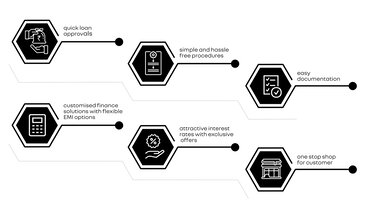

Key Benefits

How is it a one stop shop?

- Vehicle cost: Ex-showroom price of the vehicle

- Renault secure: Extended warranty to keep your car secured

- Renault genuine accessories: Personalisation options to match your needs

- Payment protect insurance: Coverage in case of death or permanent disability

- Job loss cover: 3 months EMI coverage to salaried personnel, in case of loss of job due to layoffs, retrenchment, accidental death, permanent disability and hospitalisation in case of any disease*

- EMI protect plan - 3 months EMI coverage for self-employed customers, in case of hospitalization*

* t&c apply

eligibility criteria

Just a few things we need from you before we proceed:

Salaried employee

This category includes salaried doctors, CAs, employees of select public and private limited companies, government sector employees such as public sector undertakings and central, state and local bodies.

You should:

- Be at least 21 years old (at the time of loan application) and <=60 years old (at the end of the loan tenure)

- Have had a job for at least 2 years and a minimum of 1 year with your current employer

- Earn an income of at least Rs. 250 000/- per annum

- Have a telephone / mobile connection

Documents you will need to submit:

- Identity proof - Passport, PAN card, Voter’s ID, Proof of possession of Aadhaar, Driving license

- Income proof - Last 2 months’ salary slips with 3 month’s bank statements

- Address proof - Voter’s ID / Passport / Proof of possession of Aadhaar / Driving license

- Employment ID card issued by employer

Self-employed individual

This category includes self-employed sole proprietors in the business of manufacturing, trading or services.

You should:

- Be at least 25 years age (at the time of loan application) and <=65 years age (at the end of the loan tenure).

- Be in business for at least 3 years.

- Earn an income of at least Rs.2,50,000 per annum.

- Have a telephone/mobile connection.

Documents you will need to submit:

- Identity Proof: Passport, PAN Card, Voters Id Card, Proof of Possession of Aadhaar, Driving License.

- Income Proof: Latest 2 years ITR/Own House proof with last 3 months bank statements.

- Address Proof: Voters Id Card/Passport/Proof of Possession of Aadhaar/Driving License.

- Business Registration Certificate issued by State/Central Govt. Authorities.

HOW TO FINANCE YOUR RENAULT?

conatact renault finance

CUSTOMER SELF SERVICE PORTAL

Login to https://myloan.nrfsi.com/ using your registered mobile number

Android users download the mobile app “NRFSI – My Loan” from Google Play Store or App store.

CALL CENTRE

Call Times -

09:30 AM to 06:30 PM Monday to Friday

09:30 AM to 01:30 PM on Saturday

1800-315-4444 Select Option 4 for Finance

EMAIL support

csupport.renaultfinance@nrfsi.com

WHATSAPP CHATBOT

Send “Hi” to +91 8939187374 on WhatsApp from your Registered Mobile Number